Different Digital Paths to Financial Inclusion

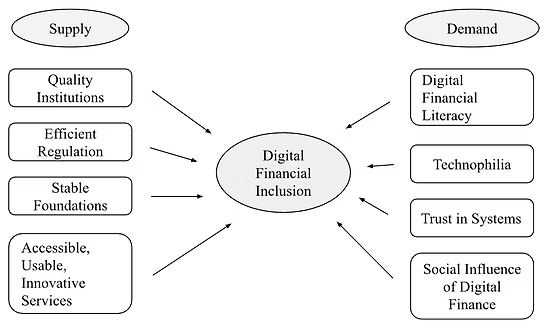

Why the USA, China, and India Use Different Approaches to Digital Finance to Expand Financial Inclusion based on State Role, Market Characteristics, Market Barriers, Consumer Literacy & Trust, and Consumer Access to Innovative Firms?

Core Contribution

Summary

What have I tried to do through my research paper?

The work applies a systems lens across political, economic, and digital domains in 3 highly relevant countries, to examine how policy design and information environments shape citizen behaviour and market outcomes, translating interdisciplinary theory into empirically grounded insights that inform inclusive policy options. The result of the study is a set of policy recommendations on how India, USA, and China can adapt their current inclusion strategies for maximum effectiveness, by comparing each approach’s traits.

Academic Rigour

The technical skills I developed through this research process

The research paper combines structured literature review with comparative analysis and data-driven reasoning, drawing on case contexts across major economies to triangulate findings and surface mechanisms rather than anecdotes, which demonstrates methodological maturity at the pre-university stage

Personal Connection

Why do I care about this topic, and what have I gleaned that has changed my perspective?

I care about this because I’ve seen how the “rules” of finance change completely depending on where you’re born, and how that shapes people’s choices and futures. While researching the USA, China, and India, I realised financial inclusion isn’t just about giving people access: it’s about building trust, literacy, and systems they actually want to use. That shift made me think less like a student learning economics and more like a designer of real-world solutions.